Navigating Economic Challenges: Insights into United Kingdom Fiscal Strategies

The United Kingdom’s fiscal policies play a pivotal role in steering the nation through economic challenges. In this article, we’ll explore the key strategies employed by the UK government to manage its finances and address economic issues.

Overview of UK Fiscal Policies

The United Kingdom’s fiscal policies are a set of measures aimed at managing government revenue, expenditures, and debt. These policies are crucial for maintaining economic stability, promoting growth, and responding to unforeseen challenges.

Balancing the Budget: Fiscal Responsibility

One of the primary goals of the UK’s fiscal strategies is to achieve a balanced budget. This involves aligning government expenditures with revenue to prevent excessive borrowing. Fiscal responsibility helps maintain the nation’s creditworthiness and ensures financial sustainability in the long run.

Government Spending Priorities

The allocation of government spending is a key aspect of fiscal policy. Funds are directed towards various sectors, including healthcare, education, infrastructure, and social welfare. By strategically prioritizing spending, the government aims to address societal needs and stimulate economic growth.

Taxation Policies: Revenue Generation and Fairness

Taxation is a vital tool for revenue generation and shaping economic behavior. The UK employs progressive taxation, where higher-income individuals pay a proportionally higher tax rate. This approach aims to distribute the tax burden more equitably and fund public services effectively.

Debt Management Strategies

While some level of government debt is common, effective debt management is crucial. The UK employs strategies to monitor and control its debt levels, ensuring that borrowing is sustainable. This involves prudent financial planning to avoid an undue burden on future generations.

Economic Stimulus Measures

During periods of economic downturn, the UK may implement stimulus measures to spur economic activity. This can include tax cuts, infrastructure investments, and targeted spending to support businesses and households. These measures aim to mitigate the impact of recessions and promote recovery.

Adapting to Global Economic Trends

The interconnected nature of the global economy requires the UK to adapt its fiscal strategies to international trends. This involves monitoring global economic developments, trade dynamics, and geopolitical factors that may impact the nation’s financial stability.

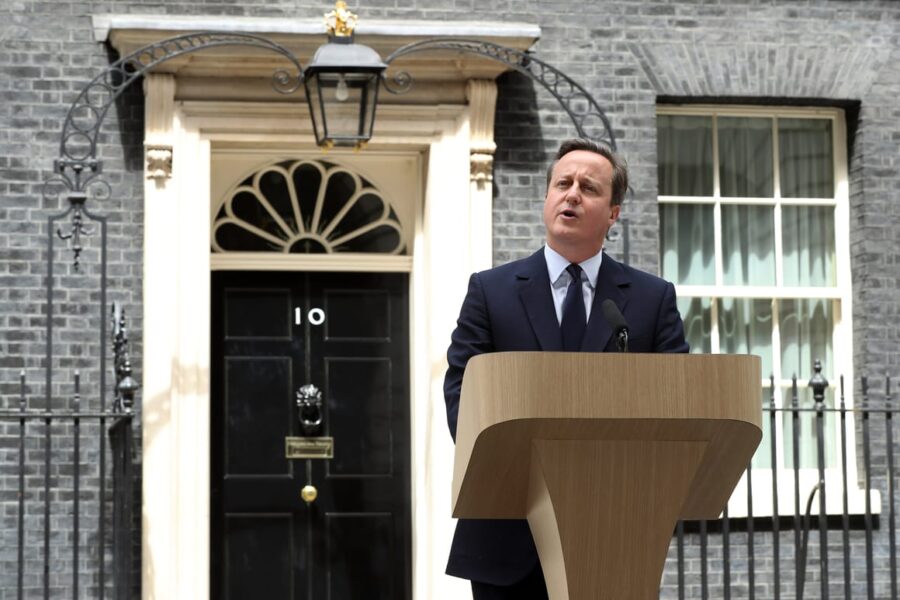

Challenges and Responses

The UK faces various economic challenges, from uncertainties related to Brexit to global economic shifts. Fiscal policies are adjusted to respond to these challenges, ensuring resilience and flexibility in the face of evolving economic landscapes.

Fiscal Policies and Long-Term Planning

Effective fiscal strategies extend beyond short-term measures. Long-term planning involves considerations for demographic changes, technological advancements, and environmental challenges. The UK government aims to create sustainable fiscal policies that address both immediate concerns and future uncertainties.

United Kingdom Fiscal: A Dynamic Landscape

For more detailed information on United Kingdom fiscal strategies and the latest updates, visit dataharza.my.id. Stay informed about policy changes, economic trends, and the government’s efforts to foster financial stability and growth.

In conclusion, the United Kingdom’s fiscal strategies are multifaceted, encompassing budgetary balance, strategic spending, taxation policies, and adaptive measures. By navigating economic challenges with foresight and flexibility, the UK aims to foster a resilient and prosperous economic future.