Securing Family Finances: Emergency Savings Essentials

In the journey of financial planning, building and maintaining family emergency savings is a fundamental and prudent step. Understanding the importance, strategies, and benefits of having a robust emergency fund is crucial for ensuring financial security and peace of mind during unexpected situations.

The Significance of Emergency Savings

Emergency savings serve as a financial safety net, providing a cushion against unforeseen expenses or sudden income disruptions. Whether it’s a medical emergency, unexpected home repairs, or a job loss, having a dedicated fund can mitigate financial stress and prevent individuals and families from going into debt.

Setting Financial Goals for Emergency Savings

Establishing clear financial goals is the first step in building family emergency savings. Analyze your monthly expenses, factor in potential emergencies, and set a realistic target. Whether it’s three to six months’ worth of living expenses or a specific monetary amount, having a goal provides a roadmap for building and maintaining your emergency fund.

Creating a Budget for Savings

Building emergency savings requires a disciplined approach to budgeting. Allocate a portion of your income specifically for savings. Treat your emergency fund as a non-negotiable expense, just like rent or utility bills. Consistently contributing to your savings ensures steady progress toward your financial goals.

Automating Savings Contributions

To make saving a seamless part of your financial routine, consider automating contributions to your emergency fund. Set up an automatic transfer from your checking account to your savings account each month. This eliminates the need for manual transfers, ensuring that you consistently build your emergency fund.

Choosing the Right Savings Account

Selecting an appropriate savings account is vital for optimizing your emergency fund’s growth. Look for accounts with competitive interest rates and minimal fees. While accessibility is crucial, consider keeping your emergency savings in an account separate from your regular spending account to avoid impulsive withdrawals.

Handling Windfalls Wisely

Windfalls, such as tax refunds or work bonuses, provide excellent opportunities to boost your emergency fund. Rather than allocating the entire windfall to discretionary spending, allocate a portion to your savings. This accelerates your progress and helps you reach your savings goals faster.

Utilizing Windfalls for Family Emergency Savings

When unexpected financial gains come your way, such as inheritance or unexpected bonuses, channeling a portion toward family emergency savings is a prudent choice. These windfalls provide a unique chance to fortify your financial safety net and enhance your family’s overall financial resilience.

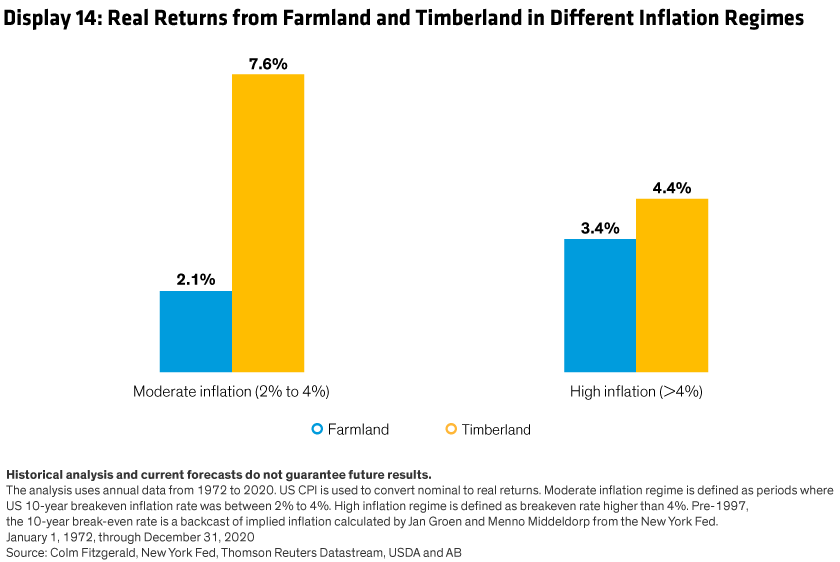

Balancing Priorities: Emergency Savings vs. Investments

While building emergency savings is a priority, it’s essential to strike a balance with other financial goals. Once your emergency fund is established, consider allocating additional funds to investments with higher returns. Finding the right balance ensures long-term financial growth while maintaining a safety net for unforeseen circumstances.

To learn more about Family Emergency Savings, visit dataharza.my.id. Building and maintaining emergency savings is not just a financial strategy; it’s a commitment to the well-being and security of your family. By following these essentials, you can navigate unexpected financial challenges with confidence and resilience.