Navigating the UK Inflation Landscape: Economic Insights

The United Kingdom, like many economies, experiences fluctuations in inflation that impact businesses, consumers, and policymakers. This article delves into the UK inflationary environment, examining its causes, effects, and strategies for navigating this economic landscape.

Understanding UK Inflation: Causes and Indicators

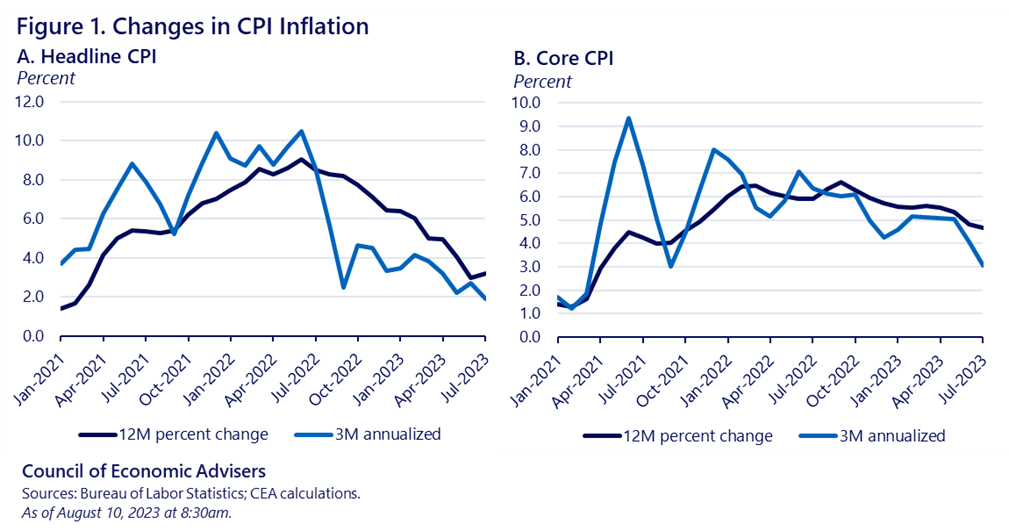

Inflation, the rise in the general price level of goods and services, can be influenced by various factors. In the UK, key contributors to inflation include changes in consumer demand, supply chain disruptions, and monetary policy decisions. Indicators such as the Consumer Price Index (CPI) and the Retail Price Index (RPI) help gauge inflation levels.

Economic Effects of Inflation on Businesses and Consumers

Inflationary environments pose challenges for both businesses and consumers. For businesses, rising costs of production may lead to reduced profit margins unless they can pass these costs onto consumers through price increases. Consumers, in turn, may experience a decrease in purchasing power as the prices of goods and services rise.

Central Bank Strategies: Interest Rates and Monetary Policy

Central banks, including the Bank of England, play a pivotal role in managing inflation. One of the primary tools is adjusting interest rates. By raising interest rates, central banks aim to cool off inflation by making borrowing more expensive, reducing consumer spending. Lowering interest rates stimulates economic activity but may contribute to inflationary pressures.

Global Influences on UK Inflation

The UK’s inflationary environment is not isolated; it is influenced by global factors. Fluctuations in commodity prices, exchange rates, and geopolitical events can have ripple effects on inflation. A globalized economy means that events occurring in other parts of the world can impact the inflationary landscape in the UK.

Supply Chain Challenges and Inflationary Pressures

Recent years have seen heightened concerns about supply chain disruptions, further complicating the UK inflationary environment. Issues such as transportation bottlenecks, raw material shortages, and labor market constraints contribute to inflationary pressures by disrupting the normal flow of goods and services.

Government Fiscal Policies and Inflation Management

Governments also employ fiscal policies to manage inflation. Public spending, taxation, and budgetary decisions can influence the inflationary landscape. Stimulative fiscal policies may boost economic activity but risk exacerbating inflation, requiring a delicate balance to achieve both growth and price stability.

Impact on Savers and Investors

Inflation affects savers and investors differently. While inflation erodes the purchasing power of money, it can also lead to higher interest rates, potentially benefiting savers. Investors need to consider the impact of inflation on the real return of their investments, particularly in assets such as bonds and equities.

Consumer Behavior and Inflation Expectations

Consumer behavior plays a crucial role in shaping inflation expectations. If consumers anticipate rising prices, they may adjust their spending habits, leading to demand-pull inflation. Managing inflation expectations becomes a challenge for policymakers, requiring effective communication and transparent economic policies.

Navigating Inflationary Environments: Strategies for Businesses

Businesses need adaptive strategies to thrive in inflationary environments. This includes implementing efficient cost management, exploring pricing strategies, and embracing innovation. Businesses that can navigate the challenges of inflation and adapt to changing market conditions position themselves for long-term resilience.

Consumer Strategies: Budgeting and Financial Planning

Consumers, too, can take proactive steps to navigate inflation. Budgeting, financial planning, and prudent spending habits become crucial. Diversifying investments and considering inflation-protected assets can help preserve purchasing power over the long term.

Adapting to Economic Uncertainty

In conclusion, navigating the UK inflationary environment requires a multi-faceted approach involving policymakers, businesses, and consumers. Adapting to economic uncertainty, understanding global influences, and implementing effective monetary and fiscal policies are essential for fostering a resilient and stable economic landscape.

For more insights on the UK Inflationary Environment, visit dataharza.my.id.