Decoding the Consumer Price Index: Economic Insights

Understanding the Consumer Price Index (CPI) is essential for comprehending economic trends and making informed financial decisions. This article delves into the intricacies of the CPI, exploring its significance, calculation methodology, factors influencing it, and its impact on consumers and policymakers.

Significance of the Consumer Price Index (CPI)

The Consumer Price Index is a vital economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of goods and services. It serves as a benchmark for inflation, allowing economists, policymakers, and businesses to gauge the cost of living and the purchasing power of consumers.

Calculation Methodology of CPI

The calculation of the CPI involves tracking the prices of a predetermined basket of goods and services commonly purchased by urban consumers. These items, ranging from groceries to housing costs, are assigned weights based on their importance in the average consumer’s expenditure. The index is then calculated as a weighted average of these prices.

Factors Influencing the Consumer Price Index

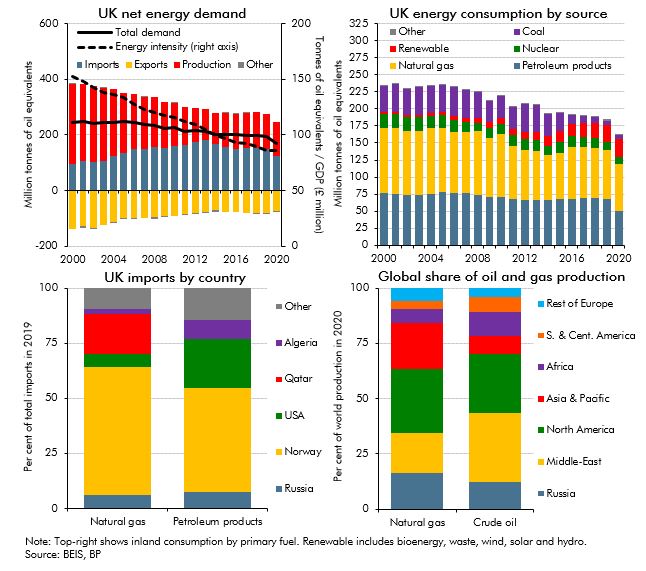

Several factors contribute to the fluctuations in the Consumer Price Index. Changes in the costs of housing, transportation, food, and energy are primary influencers. External factors such as supply chain disruptions, geopolitical events, and government policies also play a role in shaping the movements of the CPI.

Categories within the Consumer Price Index

The CPI is divided into categories, each representing a specific type of expenditure. These categories include housing, transportation, food and beverages, apparel, medical care, recreation, education, and other goods and services. Monitoring price changes within these categories provides a comprehensive view of inflationary pressures.

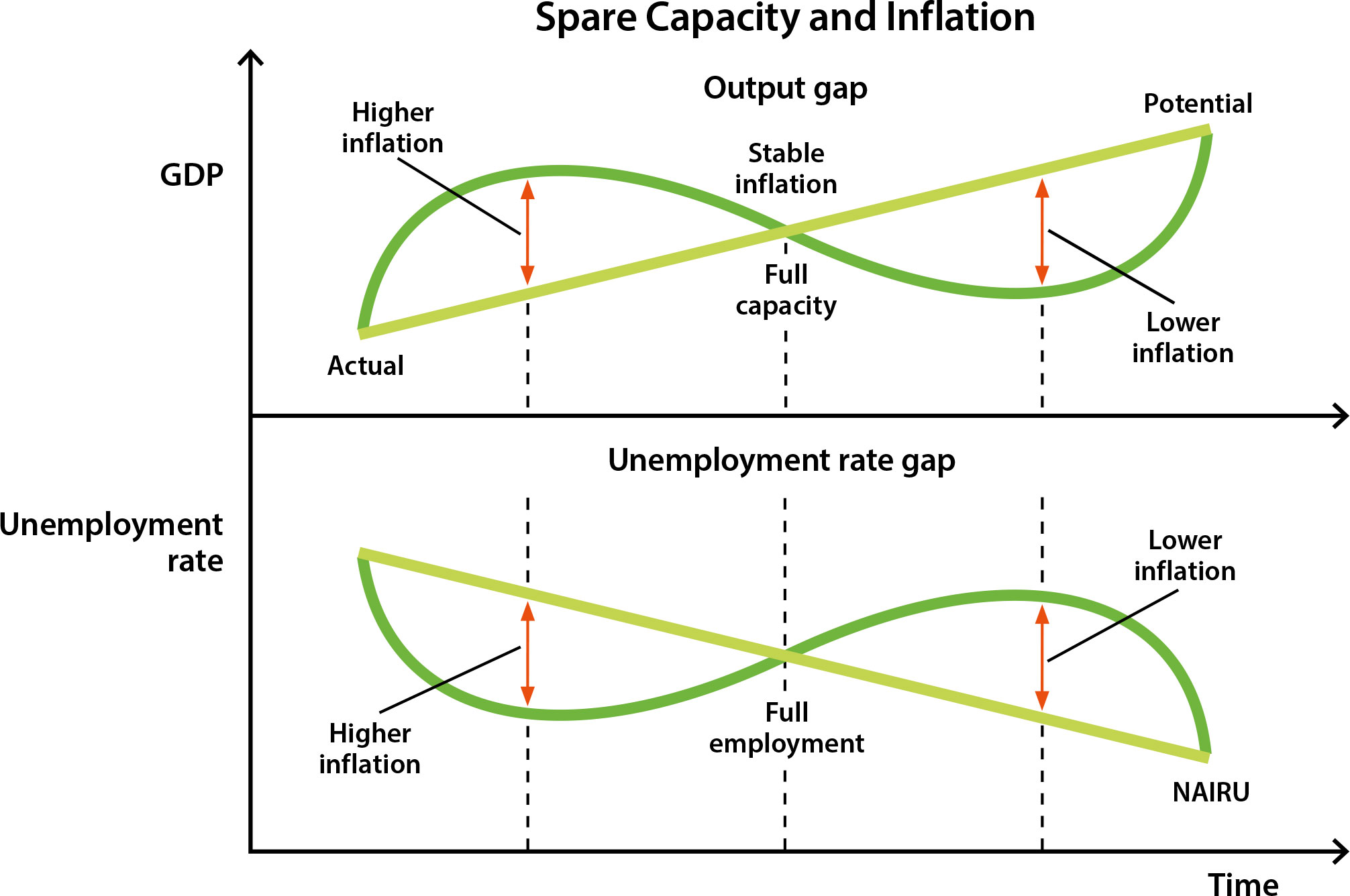

Inflation and Deflation Indicators

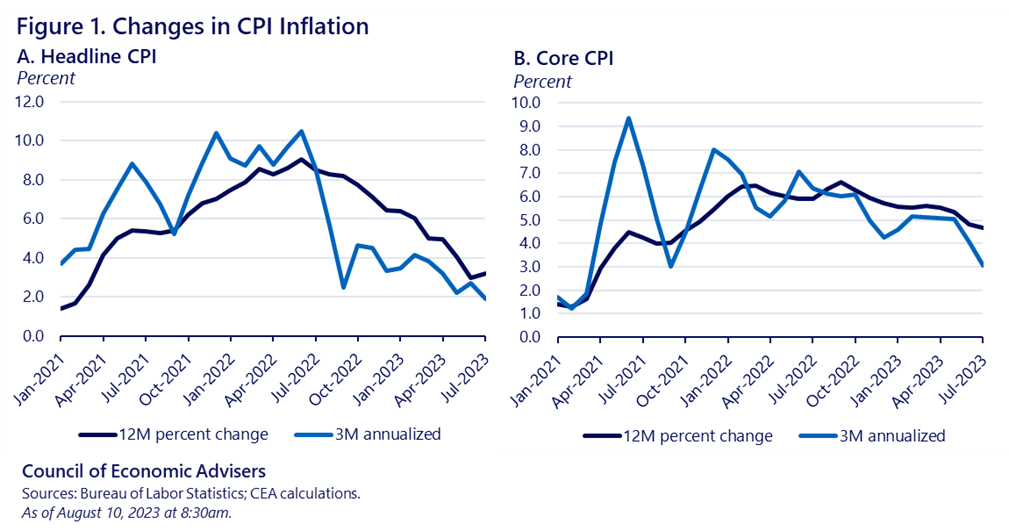

The CPI serves as a key indicator for both inflation and deflation. When the index rises, it signals inflation, indicating that the general price level of goods and services is increasing. Conversely, a decline in the index suggests deflation, signifying a decrease in the overall price level. Policymakers closely monitor these indicators to formulate economic strategies.

Impact on Consumers and Purchasing Power

The Consumer Price Index directly impacts consumers by reflecting changes in the cost of living. When prices rise, consumers may experience a decrease in purchasing power as their income buys fewer goods and services. This can influence spending habits, savings, and overall financial well-being, making the CPI a crucial tool for financial planning.

Role of CPI in Wage Adjustments and Contracts

The CPI plays a pivotal role in wage adjustments and contractual agreements. Many labor contracts, social security benefits, and pensions are tied to changes in the Consumer Price Index. This linkage ensures that income and benefits adjust in response to variations in the cost of living, providing a level of financial protection for individuals.

Policy Implications and Monetary Decision-Making

Central banks and policymakers use the CPI to inform monetary decisions. Controlling inflation is often a primary objective of monetary policy. If the CPI indicates rising inflationary pressures, central banks may implement measures such as adjusting interest rates to stabilize prices and support economic stability.

Challenges and Criticisms of the Consumer Price Index

While the CPI is a valuable tool, it is not without challenges and criticisms. Some argue that the index may not fully capture the individual experience of inflation, especially for specific demographic groups. Adjustments for technological advancements and changing consumer behaviors are ongoing challenges faced by those responsible for calculating the CPI.

Consumer Price Index and Economic Forecasts

Economists and financial analysts use the CPI as a critical component in economic forecasts. Anticipating future changes in the index allows businesses, investors, and policymakers to prepare for potential economic shifts. The CPI provides valuable insights into inflationary trends, helping stakeholders make proactive decisions.

Navigating Economic Realities with the Consumer Price Index

In conclusion, the Consumer Price Index is a fundamental tool for understanding economic realities and making informed financial decisions. From its calculation methodology to its impact on consumers and its role in policy decisions, the CPI serves as a compass for navigating the complex landscape of inflation and deflation.

For more insights on the Consumer Price Index, visit dataharza.my.id.