Exploring the Landscape of United States Monetary Policy

Understanding the intricacies of United States monetary policy is crucial in unraveling the economic fabric of the nation. In this exploration, we dissect the key components that shape monetary decisions, impact economic stability, and influence the financial landscape.

Historical Foundations: The Evolution of US Monetary Policy

The journey of US monetary policy is deeply rooted in history. From the gold standard to the establishment of the Federal Reserve, tracing the historical foundations provides insights into the principles that guide present-day monetary decisions. Understanding the evolution of policy frameworks helps contextualize the current economic landscape.

The Federal Reserve: Architect of Monetary Control

At the core of United States monetary policy is the Federal Reserve, the nation’s central bank. Tasked with steering the country’s monetary course, the Federal Reserve influences interest rates, regulates financial institutions, and plays a pivotal role in managing economic cycles. Examining the functions and decisions of the Federal Reserve unveils the mechanisms that underpin monetary control.

Interest Rates and Economic Impact: A Delicate Balancing Act

Interest rates are a linchpin in US monetary policy, serving as a tool to manage inflation, employment, and economic growth. The delicate balancing act of adjusting interest rates reflects the Federal Reserve’s efforts to navigate economic variables. Analyzing the nuances of interest rate decisions provides a window into the priorities and challenges faced by policymakers.

Quantitative Easing and Unconventional Tools: Responding to Economic Crises

In times of economic upheaval, the United States has employed unconventional tools such as quantitative easing. These measures, designed to stimulate economic activity, involve large-scale asset purchases. Exploring the use of quantitative easing and unconventional tools reveals the adaptability of US monetary policy in responding to crises.

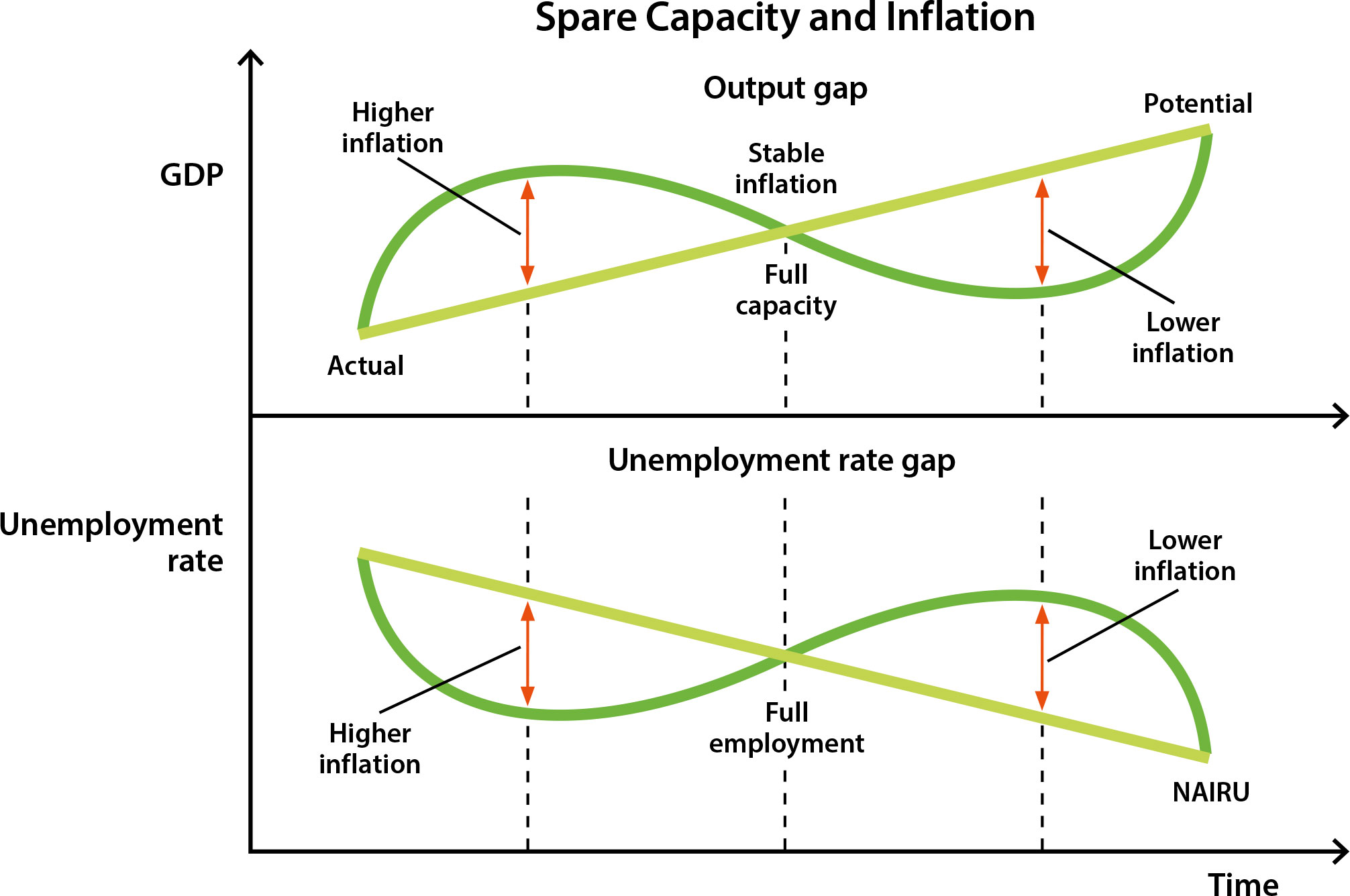

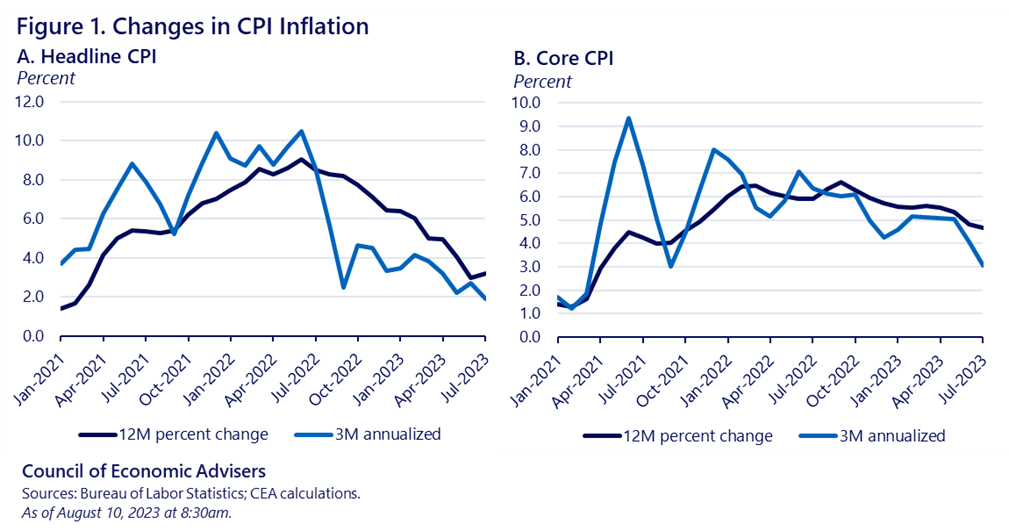

Inflation Targeting: Striving for Price Stability

Maintaining price stability is a key objective of US monetary policy. Inflation targeting, a strategy employed by the Federal Reserve, aims to keep inflation at a specific target rate. Understanding the rationale behind inflation targeting and its implications provides insights into the Federal Reserve’s commitment to fostering a stable economic environment.

Global Influences: The Intersection of International Dynamics

The United States, as a global economic player, is not immune to international influences. Global economic dynamics, trade relationships, and geopolitical events impact US monetary policy decisions. Navigating the intersection of domestic and international factors requires a strategic approach to ensure economic resilience.

Financial Regulation: Safeguarding Stability and Integrity

Beyond interest rates and monetary tools, financial regulation is a critical component of US monetary policy. Safeguarding the stability and integrity of the financial system involves oversight, regulatory frameworks, and measures to mitigate systemic risks. Examining the regulatory landscape provides a comprehensive view of the mechanisms in place to ensure financial stability.

Technology and Innovation: Shaping the Future of Monetary Policy

In an era of rapid technological advancement, the role of technology in shaping monetary policy cannot be overstated. From digital currencies to fintech innovations, exploring the intersection of technology and monetary policy offers insights into the future landscape. Adapting to technological changes is crucial for maintaining the effectiveness of monetary tools.

Challenges and Responses: Adapting to Economic Realities

The landscape of US monetary policy is not without challenges. Economic uncertainties, global shocks, and evolving financial landscapes pose constant challenges. Analyzing how policymakers respond to these challenges provides a glimpse into the adaptability and resilience of the United States monetary framework.

Looking Ahead: Charting the Course for Monetary Policy

As the United States navigates a complex economic landscape, the trajectory of monetary policy becomes a focal point for policymakers. Charting the course for the future involves considering emerging trends, embracing technological advancements, and adapting strategies to ensure the continued stability and prosperity of the nation.

In conclusion, United States monetary policy is a dynamic and multifaceted framework that plays a central role in shaping the nation’s economic realities. Understanding its historical roots, the influence of the Federal Reserve, and the response to contemporary challenges provides a comprehensive view of the intricate tapestry that defines the monetary landscape.