Inflation Dynamics: Navigating the US Economic Landscape

The economic landscape in the United States is shaped by various factors, and one of the critical elements influencing financial decisions and policies is the inflationary environment. This article explores the dynamics of inflation in the U.S., its impact on different aspects of the economy, and strategies for navigating this complex economic terrain.

Understanding US Inflation: Causes and Indicators

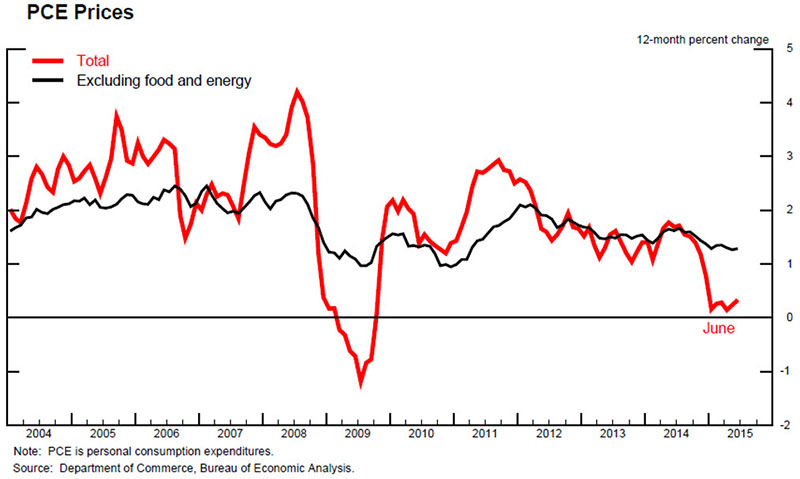

Inflation, characterized by a general increase in prices, is influenced by several factors in the U.S. Understanding the causes, such as changes in consumer demand, supply chain disruptions, and monetary policies, is crucial. Key indicators like the Consumer Price Index (CPI) and the Producer Price Index (PPI) help economists and policymakers assess the level of inflation.

Effects of Inflation on Consumers and Businesses

Inflationary environments affect both consumers and businesses. For consumers, rising prices mean a decrease in purchasing power. Businesses, on the other hand, face increased production costs, which may impact profit margins. Understanding these effects is vital for making informed financial decisions and policy adjustments.

Monetary Policy and the Federal Reserve

The Federal Reserve plays a pivotal role in managing inflation through monetary policy. By adjusting interest rates and employing other tools, the Fed aims to control inflation and promote economic stability. Understanding the strategies employed by the Federal Reserve is essential for businesses, investors, and individuals.

Global Influences on US Inflation

The U.S. economy is intricately connected to the global market. Factors such as international trade, commodity prices, and geopolitical events can influence inflation in the U.S. Understanding these global influences provides a comprehensive view of the inflationary environment and its potential impact.

Supply Chain Challenges and Inflationary Pressures

Recent years have witnessed significant disruptions to global supply chains. These challenges, including transportation bottlenecks and shortages of raw materials, contribute to inflationary pressures. Analyzing how supply chain dynamics impact inflation is crucial for policymakers and businesses navigating the current economic landscape.

Government Fiscal Policies and Inflation Management

Besides monetary policy, fiscal policies enacted by the U.S. government play a role in managing inflation. Decisions related to government spending, taxation, and budgetary allocations can impact inflationary pressures. Policymakers must strike a balance to stimulate economic growth while avoiding excessive inflation.

Impact on Financial Markets and Investments

Inflation has profound effects on financial markets and investments. Investors need to consider the impact of inflation on real returns and adjust their investment strategies accordingly. Certain assets, such as real estate and commodities, may act as hedges against inflation, and understanding these dynamics is crucial for a well-diversified portfolio.

Consumer Behavior and Inflation Expectations

Consumer behavior contributes to the feedback loop of inflation. If consumers anticipate rising prices, they may adjust their spending habits, contributing to demand-pull inflation. Managing inflation expectations is a challenge for policymakers, requiring effective communication and policy adjustments.

Business Strategies for Inflationary Environments

Businesses need adaptive strategies to thrive in inflationary environments. This includes efficient cost management, pricing strategies, and agility in responding to changing market conditions. Businesses that understand the nuances of inflation can position themselves for resilience and sustainable growth.

Individuals and Inflation: Navigating Personal Finances

Individuals must navigate their personal finances in an inflationary environment. This includes budgeting, making informed investment choices, and exploring ways to preserve purchasing power. Financial literacy becomes a crucial tool for individuals seeking to navigate economic uncertainties.

Collaborative Efforts for Economic Stability

In conclusion, the dynamics of the U.S. inflationary environment are intricate and multifaceted. Navigating this economic landscape requires collaborative efforts from policymakers, businesses, investors, and individuals. Understanding the causes, effects, and strategies for managing inflation is essential for fostering economic stability and resilience.

For more insights on the US Inflationary Environment, visit dataharza.my.id.