Navigating Inflationary Pressures: Insights on America’s Economic Landscape

Navigating Inflationary Pressures: Insights on America’s Economic Landscape

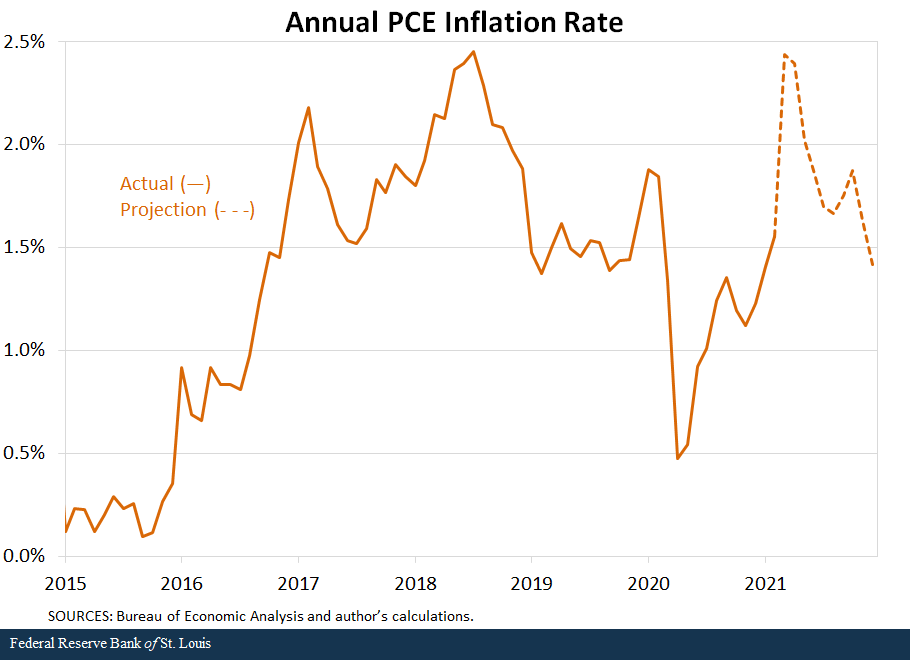

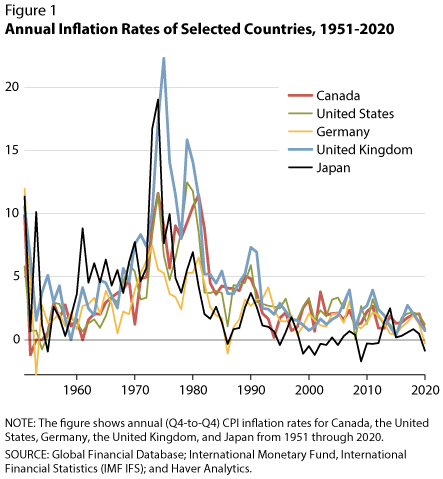

The economic landscape of America is currently experiencing inflationary pressures, impacting various sectors and influencing financial decisions. Understanding the factors contributing to inflation and how individuals and businesses can navigate these pressures is essential for informed decision-making.

Understanding the Causes of Inflation

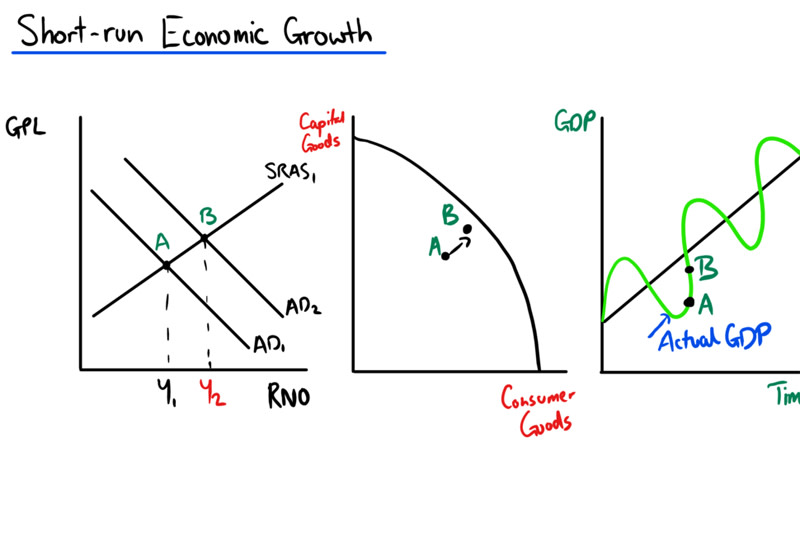

Inflationary pressures in America are driven by various factors. Increased demand for goods and services, supply chain disruptions, and rising production costs contribute to the overall increase in prices. Understanding these root causes helps individuals and businesses make sense of the economic forces at play.